Envita Health™ for Employers With 25 Employees or More

We give your employees a huge upgrade with a precision healthcare experience that's finally outcome driven! With Envita Health™, they will be happier and healthier, making them more likely to stay with your company for the long term. We make it simple to break free from the limitations of large insurance companies and avoid wasting time and money, with the sole focus of improving outcomes!

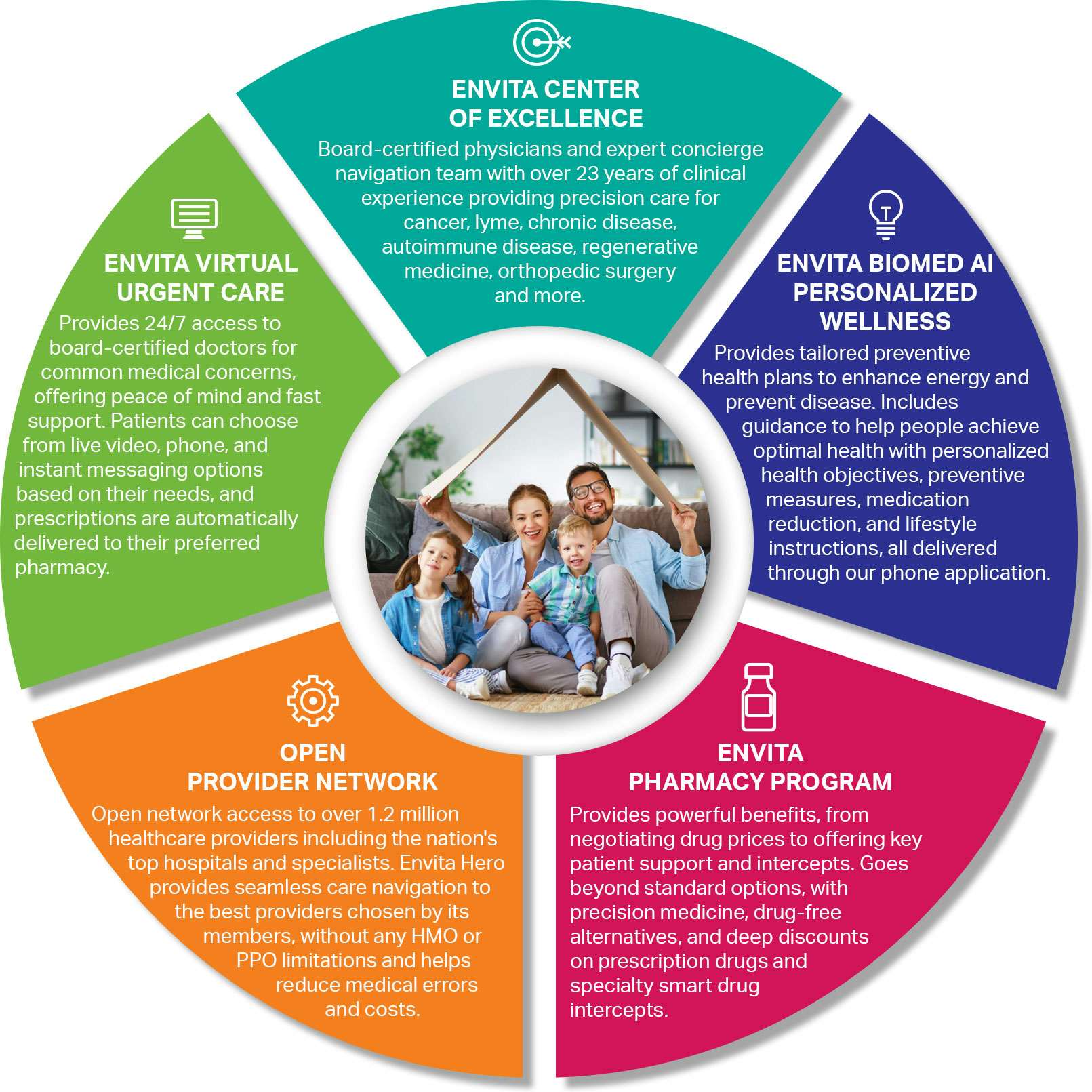

Envita Health™ Solutions for Employers

The Difference is Clear! Envita Health™ Self-Funded and Level-Funded Plans vs. Standard Insurance

Checked

Checked Checked

Checked Checked

Checked Checked

Checked Checked

Checked Checked

Checked Checked

CheckedGo Beyond Standard Insurance Limitations With Envita Health's™ Core Essentials

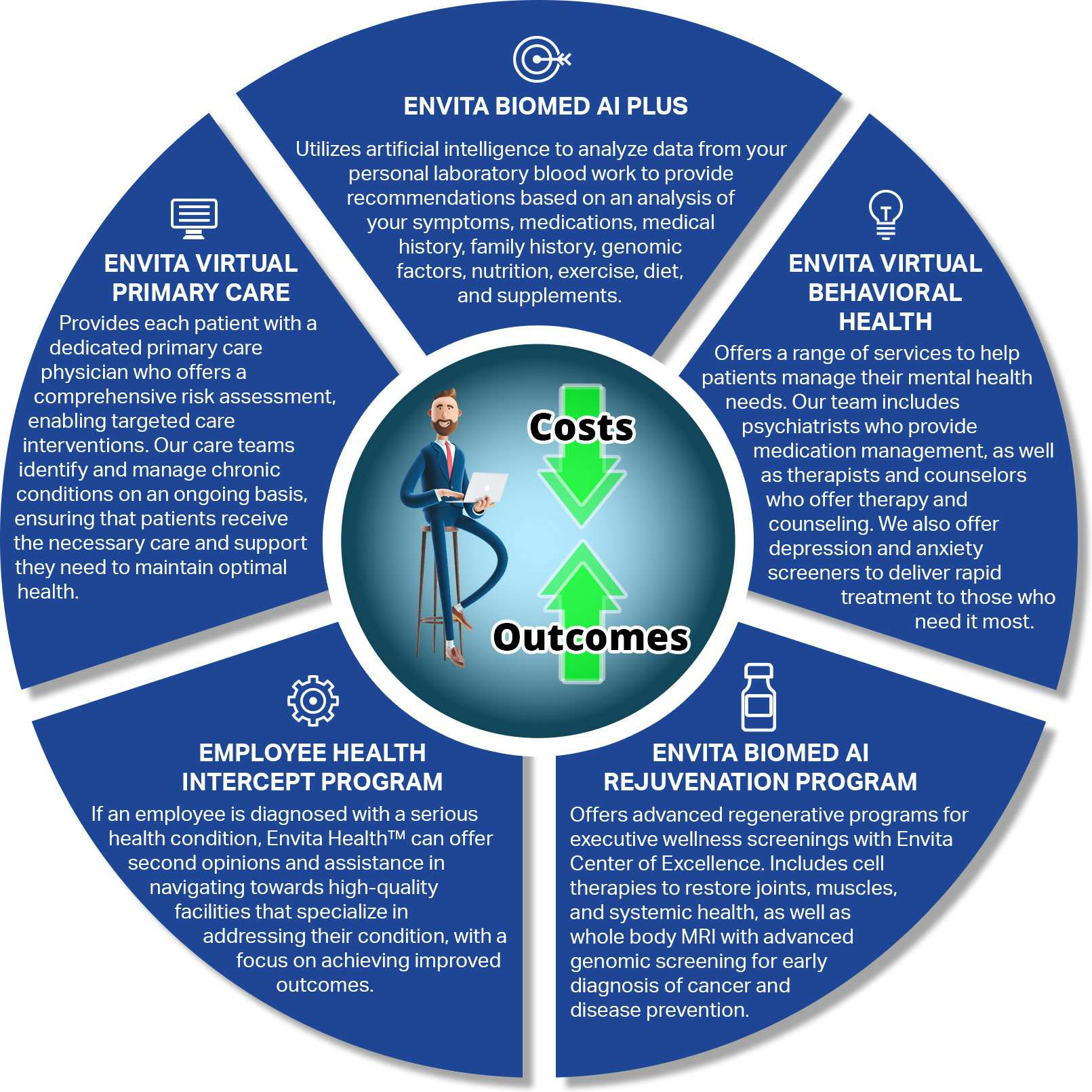

Envita Health™ BioMed Add On

Crafted to improve patient outcomes while taking advantage of tax incentives, our plan also eliminates co-pays for primary care, virtual primary care, behavioral health, generic drugs, and advanced personalized preventive medicine programs.

U.S. Healthcare Data

77 YearsLow life expectancy among developed countries.

The U.S. spends more on healthcare as a share of the economy — nearly twice as much as the average OECD country — yet has a lower life expectancy than the OECD average.

As your employees can now access premium healthcare services for which Fortune 500 companies hire specialized teams, your employees will feel valued as you out maneuver the competition with Envita Health!

We wanted our employees to get the highest level of care, a wide-variety of treatment options, and advanced preventive care, with the latest technology, navigation, and expansive network, so we built Envita Health™!

The Need to Change Large Insurance Providers

Envita Health™ breaks free from these limitations and finally upgrades care for our employees and others. We focus on utilizing precision technology and world-class navigation to optimize patient outcomes!

U.S. Healthcare Data

Expect 20% or Moreemployer cost increase per year.

The majority of insurance companies will be increasing rates by 20% or more.

Just like us, other employers also have a difficult time identifying the perfect solutions for better healthcare. Large insurance companies want us to believe that insurance is a complex, monolithic process, which can be provided by them alone, but this is Simply False! Their complicated processes lead to several challenges for employers.

Employers' Challenges with Healthcare

U.S. Healthcare Data

1% of Claims = 40% of Costs

1% of your company claims for cancer and chronic conditions are driving over 40% of your total overall costs year after year.

Latent Problems of Large Insurance Providers

By putting the focus on improving your access to the latest technologies, enhancing outcomes, and offering a precision healthcare experience, Envita Health's™ custom solutions provide employees with an opportunity to live a longer, happier, and healthier lives, resulting in cost stabilization for employers.

Visible Intelligent Solutions

You can see how we outperform Fortune 500 company programs. Join our nationwide growing community and offer a huge health upgrade to your employees!